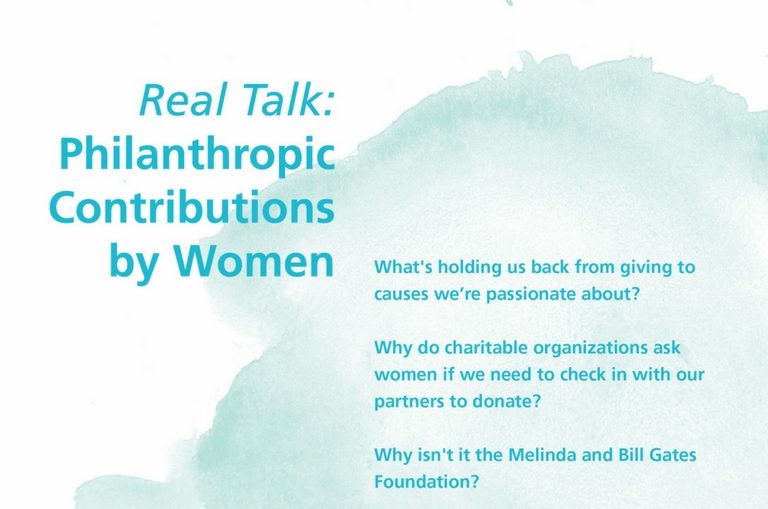

Women embracing philanthropy with financial planning

There is good in all of us. Particularly in Canada, we all make an effort to help those in need, whether it’s making donations, attending fundraisers or volunteering with a community group.

Have you thought about your legacy?

Go ahead and celebrate it: you’re a successful woman! Your hard work and good fortune enable you to start thinking about giving back to your community, so now the big question is how to go about doing this. When you reach the point of sharing your wealth, it takes on greater meaning and allows you […]