Receiving a bonus is an excellent opportunity to strengthen your financial future. While the impulse to indulge in a well-deserved treat is natural, considering a strategic financial move like contributing to your registered retirement savings plan (RRSP) can set the stage for significant rewards in the years ahead.

By directing your bonus to your RRSP, you can supercharge your retirement savings while taking advantage of powerful tax benefits.

The 60-Second RRSP Refresher

What is it?

An RRSP is a powerful investment tool that delays the timing of when you pay income tax. This may not sound significant, but the impact on your finances can be substantial.

How does it work?

Directing your bonus to your RRSP allows you to invest pre-tax income, separating it from your taxable income before the government takes a big bite out of it. As the investments within your RRSP account grow over the years, any dividends, interest, and capital gains that they accumulate are not taxed.

How does this help me?

By starting with a larger pre-tax amount and avoiding tax deductions as it grows, your RRSP has the potential to grow much larger compared to investments made over the same period that are not tax-protected.

Reap the Rewards of a Tax-Protected Investment

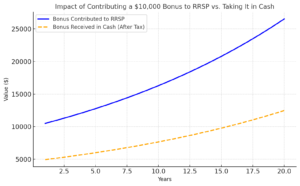

The graph below illustrates the difference between contributing a bonus of $10,000 towards your RRSP vs. getting your bonus in cash (taxed at 53%). In both cases, we assume a growth rate of 5% per year.

As the graph shows, putting your bonus into your RRSP can help you reap significant rewards over the long term.

Follow the Rules or Pay a Price

To take advantage of the great benefits offered by RRSPs, you need to stay within the contribution limits.

For the 2025 RRSP season, individuals are allowed to contribute up to 18% of their income or $30,780 – whichever is lower.

Keep in mind:

- Some factors can reduce your contribution limit (e.g., contributions made to your employer’s pension fund).

- Some factors can increase your contribution limit (e.g., unused contribution room from a previous year).

You can find your contribution room for 2025 on your latest notice of assessment from CRA. If you can’t locate your NOA, contact your accountant or the CRA.

In general, withdrawing funds from your RRSP before you retire will result in a considerable penalty, so this is something to avoid unless absolutely or strategically necessary.

There are exceptions when early withdrawals are allowed – such as to pay for education or buy a house – but these withdrawals must meet specific criteria. To ensure you don’t accidentally break the rules, it’s always a good idea to consult your financial advisor before withdrawing.

Don’t Miss the Deadline

Timing is critical when it comes to your RRSP. To be counted by CRA as an RRSP contribution for the 2024 tax year, it must be made by March 1, 2025.

This means that if you want to put your bonus to work in your RRSP, you need to act now:

- Speak with your financial advisor about how to use your bonus to maximize the value of your RRSP.

- Determine your RRSP contribution room.

- Check with your employer for any internal deadlines for directing your bonus towards your RRSP (this may be earlier than the CRA deadline).