How a family office function established a cohesive financial plan with fully-aligned service providers for a successful business family

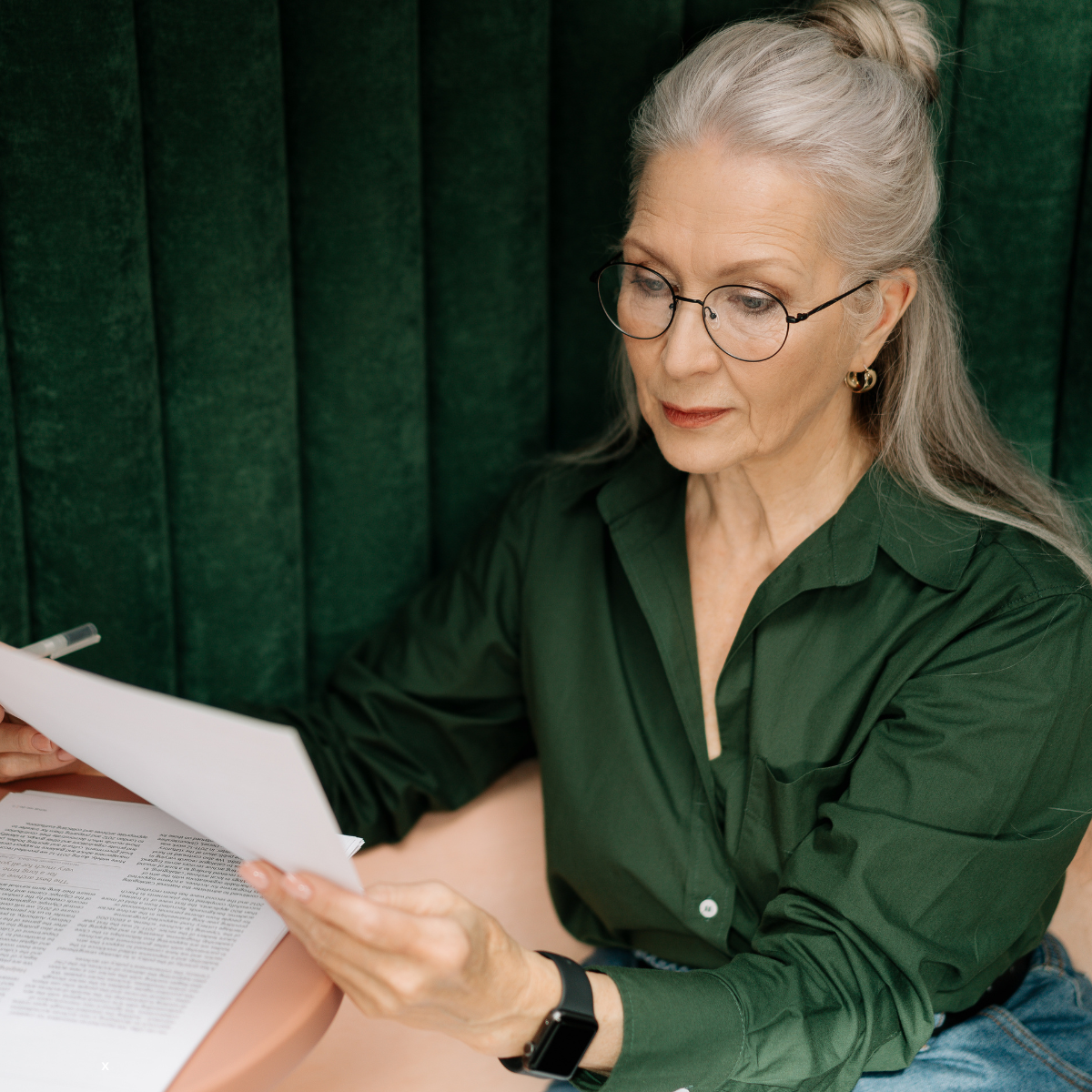

Angela, the matriarch of a highly successful business family, had accumulated significant assets across multiple investment accounts but felt overwhelmed by the complexity of managing them.

The family business had a complex corporate structure that included actively involved family members alongside an external shareholder. This made it increasingly intricate – and sensitive – for Angela and her family to manage their financial affairs.

Despite a long-standing relationship with a private bank that handled much of the family’s business banking, Angela recognized the need for an independent perspective to bring clarity and structure to her financial life. At the same time, she did not want to disrupt existing relationships.

Adding to the challenge, Angela worked with multiple advisors, tax professionals, investment managers, and legal experts who were often not aligned in their advice and did not coordinate their efforts. Estate planning was also a growing concern, as Angela started to think about how the family could ensure a smooth transition of wealth while protecting the business.

During Angela’s first meeting with Rubach Wealth, what was clear immediately was that, in addition to a comprehensive financial plan, she needed a team that could take on a family office role and coordinate all her banking relationships and professional advisory services. For Rubach Wealth, the ultimate goal was to help Angela and her family gain better control of their wealth through a cohesive plan executed by fully-aligned service providers.

Here’s how Rubach Wealth helped her regain control:

- Consolidating a fragmented financial picture. Rubach Wealth implemented a comprehensive financial plan, bringing together all of Angela’s accounts, investments and assets into a single, strategic framework. This gave her a clear, consolidated view of her wealth and a roadmap for decision-making.

- Aligning financial professionals. With multiple advisors working in silos, Angela faced inefficiencies and potential risks. Rubach Wealth stepped in to facilitate coordination among her tax, legal and investment professionals, ensuring that all aspects of her financial strategy worked together in the most effective and tax-efficient manner.

- Safeguarding the family business and legacy. Rubach Wealth developed a business succession plan, managed shareholder dynamics and established a tax-efficient wealth transfer strategy to safeguard the family’s legacy for future generations.

- Complementing private banking relationships. Rubach Wealth worked alongside Angela’s private bank, offering an independent second opinion while ensuring a seamless integration of financial services.

- Ongoing oversight for long-term success. To keep pace with changing market conditions and evolving family needs, Rubach Wealth established a structured review process. This ongoing oversight ensured that financial strategies remained aligned with Angela’s long-term goals.

From overwhelmed to peace of mind

With a well-organized financial strategy in place, Mrs. Williams gained peace of mind, knowing that her wealth is structured efficiently, her advisors are aligned, and her family’s financial future is secure. By working with Rubach Wealth, she was able to transition from feeling overwhelmed to confidently managing her financial affairs with clarity and purpose.

We helped Angela. How can we help you?

If you’re a business owner or high-net-worth individual navigating complex financial decisions, Rubach Wealth offers expert guidance to bring structure and strategy to your wealth. Whether you’re seeking a second opinion, advisor coordination, or estate planning support, we provide tailored solutions to help you take control of your financial future.

Let’s start a conversation—contact us today.