Truth is, basic life insurance need varies greatly depending on many factors and for such reason, consider speaking with an insurance professional but we’ll review a few basics for you to start thinking about.

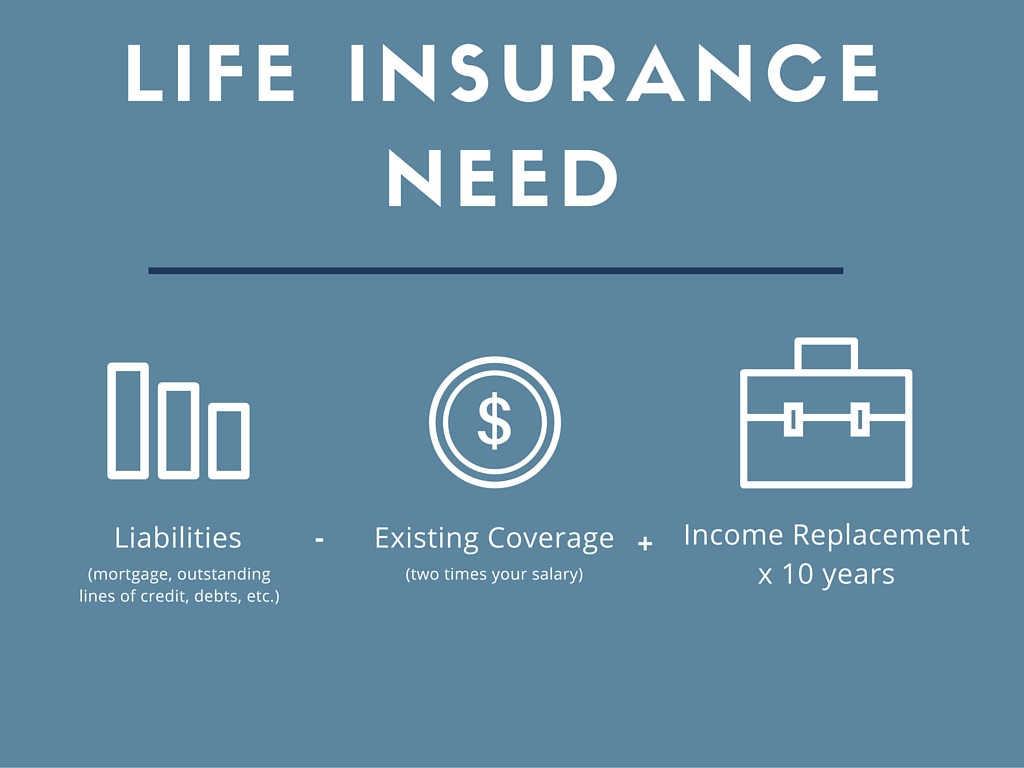

For individuals, a good rule of thumb for to calculate basic life insurance need is:

Example:

A family with two young children under the age of 10, may look like the below. However, given the young age of their children, Brenda and Jack may consider more years of income replacement.

Brenda’s income: $86,000 gross

Jack’s income: $84,000 gross

Current mortgage: $350,000

Line of Credit: $75,000

Credit Cards: $0

Outstanding Student Loans: $11,000

Coverage Through Work: (2x salary)

- Jack: $168,000

- Brenda: $172,000

Individual Life Insurance Need:

[tweet_box design=”default” excerpt=”How to calculate basic life insurance need”]Liabilities (mortgage, outstanding lines of credit, debts, etc.) – Existing Coverage + Income Replacement x 10 years[/tweet_box]

Brenda:

- ($350,000 + $75,000 + $11,000) – $172,000 + (10 x $86,000) = $1,124,000

Jack:

- ($350,000 + $75,000 + $11,000) – $168,000 + (10 x $84,000) = $1,108,000

What do these numbers actually mean? Is it truly this simple? All you have to do is insure yourself and your spouse based on such calculation? Before jumping the gun, answer the following questions:

In the event something happens to you and/or your significant other:

- What exactly would you like to leave your family with?

- Would your spouse start or continue working? Full time? Take time off?

- Do you use pre-or after tax income to calculate the need for income replacement?

- In terms of existing coverage through work, do you have job stability? Are you planning on changing jobs or start something yourself?

- Any specific instructions on how the insurance proceeds must be distributed?

- Do you have a will and powers of attorney?

- Any special needs in the family?

Answering these questions frankly will allow you to dig deeper into how to calculate your basic life insurance need and understand how much is required to support your family, if anything happens.

Cash Flow:

Although, every person and family situation is different, at the end of the day, [tweet_dis excerpt=”#Lifeinsurance amount depends on your existing cash flow. Learn how to calculate how much you need”]the amount of life insurance depends on the existing cash flow of the family[/tweet_dis]. Having some insurance is better than no insurance. Typically, using pre-tax as the difference in cost of insurance is very small and the benefit much larger, especially for younger people.

You’re Healthy Now?

Keep in mind that today, you’re most likely insurable (given you lead a healthy lifestyle). While tomorrow, you can’t be sure of that. [tweet_dis excerpt=”Will you be insurance tomorrow? Maybe, maybe not. Calculate how much #lifeinsurance is enough today”]Your age, health and lifestyle will determine your insurability and ultimately the cost of insurance[/tweet_dis].

Stay at Home Spouse:

Also, if your spouse does not work, that doesn’t mean life insurance is not needed. It is even more important! In the unfortunate event if something happens to your stay-at-home spouse and if you’d like to continue working “at the same pace”, you’ll likely have to organize and hire people to do everything your spouse does.

Life insurance will not bring the person back, however, it will give the surviving members of the family options avoiding the need to make rushed decisions such as getting “any job” or having to sell the house because the surviving spouse is not able to carry the costs of the house alone.

One of Those Things You Never Want to Collect:

The concept of life insurance is “one of those things you never want to collect” but please consider that if for any unfortunate event/accident both parents passed away in an accident (and it happens), ensure that whomever takes on your children, doesn’t regrets having accepted them because of financial hardship imposed on such person due to the lack of proper funding of your guardianship wishes.

Tie Loose Ends:

Lastly, tie every loose end with a will duly drafted by a lawyer (please, no will kits!).

[/tweet_dis_img]

[/tweet_dis_img]