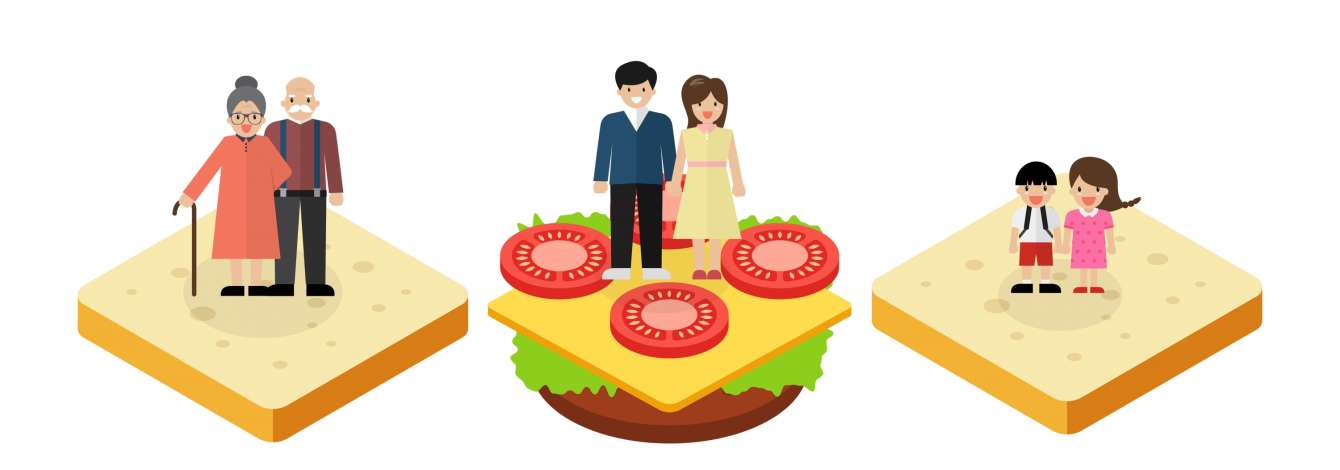

Sandwich, panini, squeezed middle or the juggling generation. Regardless of the label you choose you adopt, if you’re among the group of Canadians aged 45 to 64 who are caring for both parents and children, you know the difficulties of carrying out this dual role. But do you have a clear idea of the long-term financial and personal implications for you and your family?

What’s the plan?

The thing about being part of the sandwich generation is that it’s hard to plan for tomorrow because so you’re so busy trying to keep up with today. Even if you had a nano-second to devote to planning, you may not know what that plan can and should look like. In most cases, this boils down to one reason: you haven’t had “the talk” with the parties involved, namely your parents, children and your spouse or partner if you have one.

Discuss the details

What should this conversation cover? While the details would vary from one family to another, this discussion should look at your current situation, how it might evolve over the next several years and what resources, infrastructure and supports you need to have in place for future eventualities. For example, if it makes better sense for your parents to move from their home to yours, should you consider building an addition to your house? Will you need retrofits to make your home accessible? Should you bring in a personal support worker to lend a hand?

Have the money talk

As you go through these details, you’ll need to bring up that subject many people hate talking about: money. Have a frank discussion about all the costs related to this stage in all of your lives and how you as a family can cover these costs. If your parents are selling their house to move into yours, should you they give you a portion of the sale price? Should they pay rent? Or, to preserve their cash flow, would it be better if they allocated a bigger part or their estate to you and less to the other family members who aren’t involved in their care? These are just examples of financial considerations you need to put on the table.

Encourage advance care planning

No one likes to imagine they could get so sick or disabled they can’t make medical and legal decisions for themselves. Most people don’t like talking about this possibility either, but it can and does happen. This is why it’s important for your parents – and for you – to have an advanced care plan that states in writing what you would like to happen in situations where you aren’t medically able to articulate your wishes. Part of creating an advanced care plan involves assigning power of attorney to one or more persons you trust to make decisions that align with your goals or values. This is an important role – and a great responsibility for the person carrying it – so choose with care and make sure the person you choose is comfortable with this role.

Is there a financial and estate plan?

Whether they have significant assets or a modest nest egg, it’s important for your parents to have an updated financial and estate plan in place at this stage in their lives. Their life circumstances are shifting, and these changes should be reflected in their financial strategy, their will and estate plan. It may be a smart move now to rent or sell that Sarasota condo. If there’s a family cottage, why not sit down with other family members to ask how they feel about this lakeside property – sell or keep for the grandkids? It’s also a good idea to have a family discussion about your role as the caregiver for your parents and how this would factored into everyone’s share of your parents estate. It’s true, these are not pleasant topics to discuss but not talking about these matters today could lead to even greater unpleasantness tomorrow.

Thinking of going D-I-Y? Think again

As you continue to care for parents, there may be a blurring of your finances and theirs. At the same time, most major financial decisions they make – like selling their house or renting out a vacation property – will have tax and income implications for them and potentially for you as well. This is where experienced professionals can really help. Talk to your financial advisor, accountant or lawyer before moving forward with any major changes. Encourage your parents to review their financial plan with their advisor and, if they haven’t done so already, to set down an advance care plan and estate plan. Then take your advice and get your own plans in order.