As a business owner, you have invested huge amounts of time, energy and money into your business over the years, and you want to see it continue to thrive for years to come. However, sooner or later you also want to extract some of the value that you’ve built up in the business – preferably in the most tax-efficient way possible.

Can you achieve both goals? Yes, with strategic shared ownership of a critical illness (CI) insurance policy.

Two needs, one solution

You are likely familiar with CI insurance: if you fall seriously ill and are unable to work, CI insurance can pay out a benefit to help cover your lost income. When a CI policy for an owner or key employee is owned by a corporation, it can likewise serve as a risk management tool. If you can’t work due to a serious illness, the CI benefit can provide much-needed funds to maintain smooth business operations.

While CI insurance offers crucial support if you fall ill, does it go to waste if you remain healthy? Not necessarily. Adding return of premium (ROP) coverage to the CI policy means that all the premiums that have been paid will be returned if the policy expires or is cancelled after a specified period. And if you are the beneficiary of this ROP benefit, this can provide a significant financial advantage.

Shared ownership, major benefits

With shared ownership of a CI policy, there are benefits no matter what happens. If you fall ill, your corporation is protected. If you remain healthy, you receive funds from your corporation on a tax-advantaged basis.

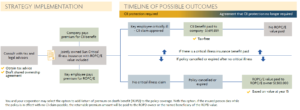

How it works:

- With help from legal and tax advisors, you and your corporation enter into a shared ownership agreement for a CI policy.

- The corporation pays the premium for the CI benefit; you pay the premium for the added ROP coverage.

- If you fall ill, the corporation receives the CI benefit payout. If you remain healthy and the policy is cancelled or expires, you receive the full premiums – both the premiums you paid AND the premiums the corporation paid – on a tax-free basis.

Why it works:

The premiums for CI insurance are not tax deductible, so both you and the corporation pay your respective premiums with after-tax dollars. However, the money that comes out of the policy – whether it’s the CI benefit payout to the corporation or the ROP payment to you – is tax-free.

The corporation pays its share of the premiums with money taxed at the corporate tax rate, which is likely lower than your personal marginal tax rate if you are in a high tax bracket. Yet when these premiums are paid out to you in an ROP situation, you do not have to pay any additional tax. In other words, this strategy allows you to pull money that is taxed only at the corporate rate out of your corporation.

Meeting your needs, no matter what happens

You work hard for the success of your business, and you shouldn’t have to choose between its financial viability and your financial rewards. With shared ownership of CI insurance, you can put in place a safety net for your business while also laying the groundwork for attractive personal financial returns.

If you would like to discuss whether shared ownership of a CI policy might be suitable given your financial situation and goals, please talk with your accountant or contact Rubach Wealth to schedule a meeting.