What’s your Family Financial Philosophy?

Some of the most important events and decisions in life can be incredibly joyful and terrifying at the same time, such as having a child, buying a home and starting a business. Deciding how to use your wealth to build a legacy – both during and beyond your lifetime – often falls into this category […]

Asking the big questions to focus on the big picture

A new year has begun, and just like every year, 2018 will have its share of ups, downs and surprises. When it comes to managing your wealth, the focus is often on long-term planning to protect against short-term blips and keep you moving forward toward your goal. But

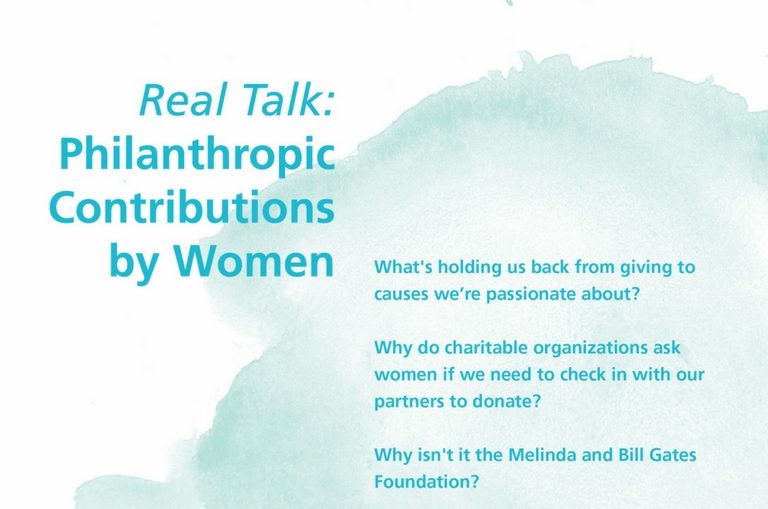

Women embracing philanthropy with financial planning

There is good in all of us. Particularly in Canada, we all make an effort to help those in need, whether it’s making donations, attending fundraisers or volunteering with a community group.

Have you thought about your legacy?

Go ahead and celebrate it: you’re a successful woman! Your hard work and good fortune enable you to start thinking about giving back to your community, so now the big question is how to go about doing this. When you reach the point of sharing your wealth, it takes on greater meaning and allows you […]