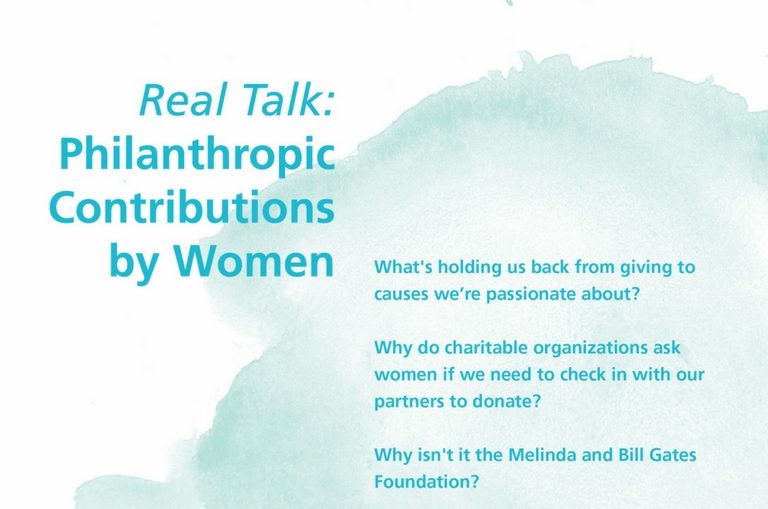

Women embracing philanthropy with financial planning

There is good in all of us. Particularly in Canada, we all make an effort to help those in need, whether it’s making donations, attending fundraisers or volunteering with a community group.

How to safeguard your business interests

As a business owner, it is important to plan for significant life events and their affect on your operations, before they happen. Knowing what happens if one of the partners passes and diligently protecting the business and its value (and therefore the family) is the sensible thing to do. One way to safeguard your business […]

A bright idea for funding post-secondary education

With a new school year starting up, September marks an important turning point in the year for many Canadians – especially us parents. If you are a parent of a school-age child, something that may be on your mind these days is the cost of post-secondary education. Even if your child has only just had […]

Act now or miss out on the benefits of permanent life insurance

Even if insurance is a topic that puts you to sleep, there is a major change coming in the insurance world deserving of your attention given its potential to significantly impact your wealth and what you are able to pass on to your loved ones. Unless you work in the insurance industry, there’s a good […]